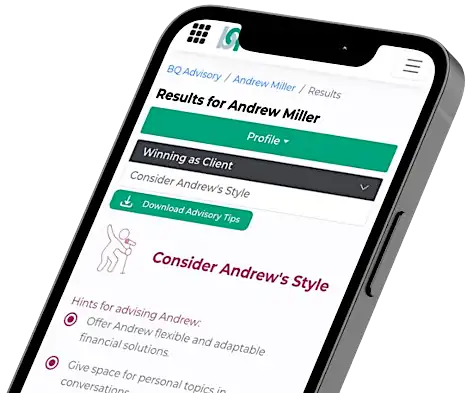

BQ Advisory makes successful, long-lasting client relationships a breeze. Tailored advice, effective communication, highest satisfaction for each single client.

BQ Performance shows how to optimize your team’s decision-making. Powerful analyses, predictions, and insights for your investment team.

BQ Select makes it easy to select the right professionals and fund managers. Full knowledge of strengths, weaknesses, and risks for your selection decisions.

BehaviorQuant shows you exactly how investment professionals and clients make their decisions. Our cutting-edge technology provides detailed quantitative profiles of individuals and teams. The latest behavioral science and AI provide insight into future behavior. Everything you need to outperform and to advise others successfully.

BehaviorQuant

Behavioral Finance Technologies GmbH

Kolingasse 6/XI • 1090 Vienna • Austria

+43 (1) 890 8418

contact@behaviorquant.com